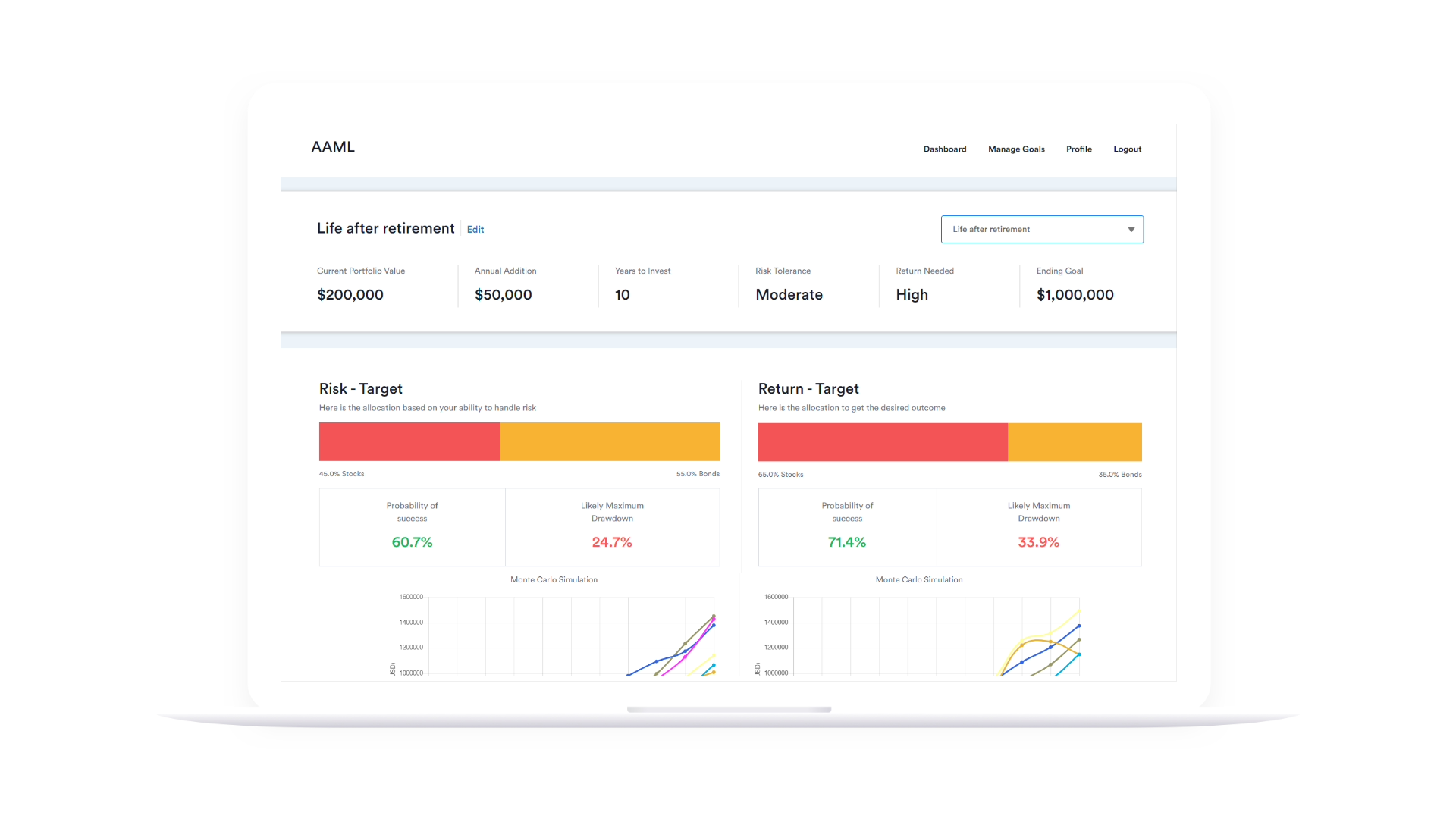

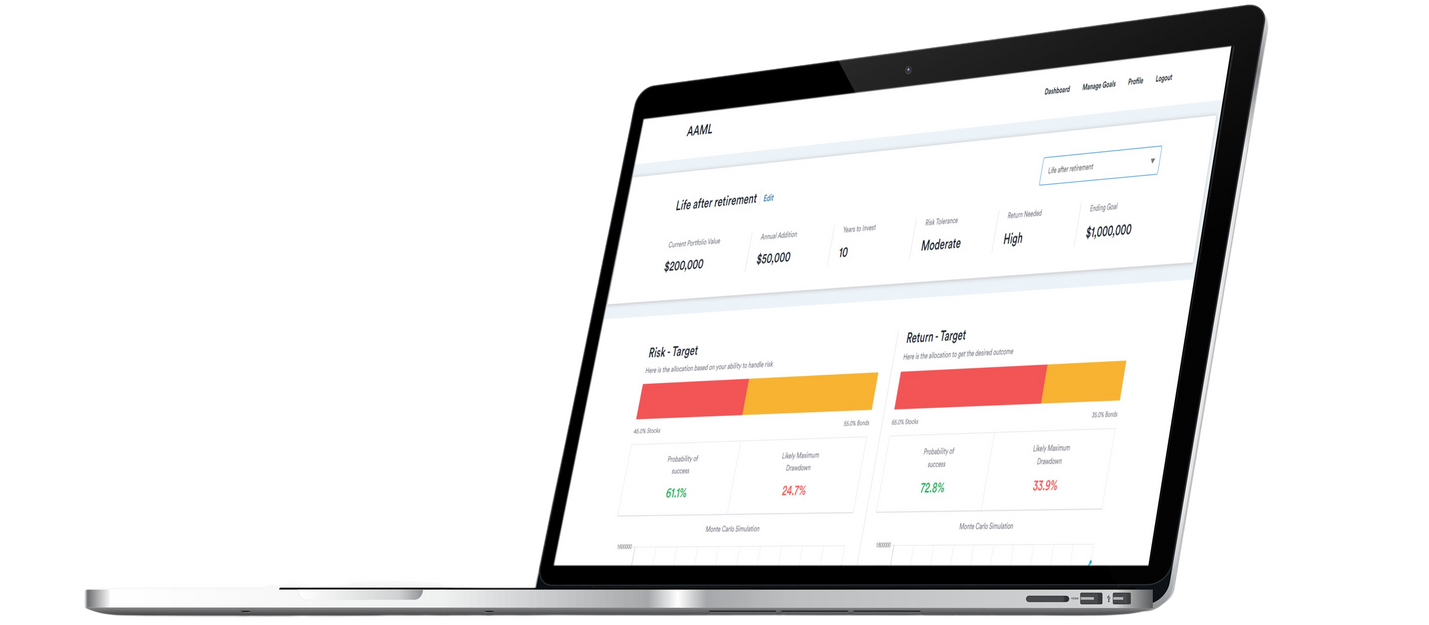

My Portfolio Advisor

Asset Allocation powered by Machine Learning to Maximize your Gains, Minimize your Losses and Achieve your Goals

Get a clear direction on where you should allocate your assets based on your personal risk-tolerance level, your financial goals and your time horizon.

Try this for Free